Welcome everyone to today's webinar, Data You Can Take to the Bank, Fleet Metrics That Matter to the Safeway. I am Aaron Gong from AGC of America, and just a few housekeeping items before we get started. If you have any questions, please type them in Q and A sections below the screen share here, and we'll get to your questions at the Q and A sections by the end of the webinar. If there's any technical issues, send me a chat and we'll troubleshoot from there. I will send a copy of the presentation in PDF near the end of the webinar, and I'll also have the recording ready in two to three business days. And with that, I'll hand it to Sarah from HCSS. Sara, I'll hand it to you.

Hello everyone, and thanks for joining us today for our webinar, Fleet Metrics That Matter. I'm Sara Chiu, I'm the Product Marketing Manager here at HCSS, and I'm super excited to spend the next hour diving into how smarter fleet management and actionable data can really help you save money, reduce downtime, and hopefully just make better business decisions.

Today, we're joined by HCSS's fleet expert, Phil. Phil has been with, HCSS for what feels like longer than I've been alive, and he is our expert in all things equipment three sixty and telematics.

We also have Michaela who has brought data to the spotlight at HCSS. This last year, she developed and launched our purpose built data reporting tool called HCSS Insights, and we'll cover that a little bit more later in the webinar.

And then finally, at HCSS, we are nothing without our customers. So today, we have Bill Ward joining us, from Active Construction and as fleet manager. We look forward to hearing your real world experiences using data and really understanding what matters to you to keep your fleet up and running.

So I'll go ahead and toss it off to Phil.

All right. Thanks, Sara.

So kind of some objectives that we're going to look to get out of the webinar. The biggest thing is going to be identifying those key fleet metrics, and once you identify those, we're going need to figure out how to use those in decision making, and then figure out how to filter out that data and only really look at what's important, especially for the right audience. Trying to get that information consolidated into your executive team so that they can make the decisions they need to make.

I think to kick us off here, we're gonna start off with a quick poll.

Aaron, if you wanna get that going real quick.

I think we'll leave this up for twenty, thirty seconds to give everybody a chance to respond. Really just to kind of level set on where everybody's at because in the sixteen years I've been doing this, I've talked to customers that are, you know, they have everything tracked and they have a report for everything, and I've talked to customers where their PMs are just memorized by their head mechanic and, everything in between.

Really nice to see where everybody's at, and then hopefully we can give you guys at least some insights on how to improve.

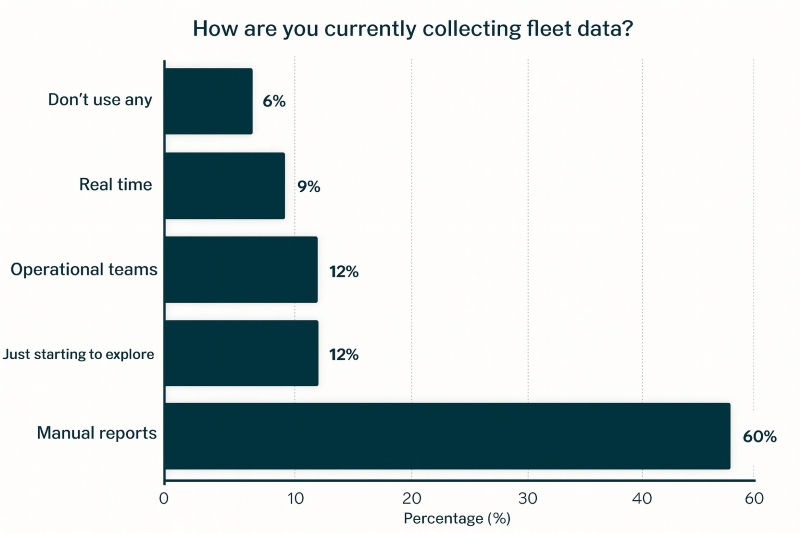

All right, excellent. Thanks, Ben. So those poll results kind of come back consistent with what I've seen, is most companies are running manual reports, Excel, or doing some other consolidation of that data to kind of analyze it.

And then you've got some people on either end that are just getting started, or have really sophisticated real time dashboards, and that's going to kind of kick us off into the next, or into the first real slide is kind of the dilemma of fleet data, is everybody's fleet, regardless of whether or not you're tracking it, generates a ton of data, and so some of that means that could be data that's either underused or it is siloed off in either accounting or your CMMS or any other system that you guys have, telematics service providers, things like that, or it's recorded manually. Yeah, the biggest one of those that we're probably gonna, everybody will be able to kind of rally around is meter readings. It's a challenge to get meter readings from the field when you're just relying on manual entry. Sometimes those pieces aren't touched for a while.

And then the thing that we're really kind of trying to talk about today is getting all that data and getting it up to your C suite or your executives or whoever your upline is that needs that data to make business decisions.

That kind of leads into some of the questions that I wanted to talk to Bill about. While we're looking at this, You know, a lot of companies are facing kind of the same challenges on the fleet side, Bill. What are you guys doing over at Active that, you know, that you've seen some kind of real return on investment as far as how you're tracking your data?

Probably our biggest generation that we did is when we moved to telematics from doing manual data entry for meter reading and the amount of utilization that has increased for the equipment. Because within a few minutes I can tell you whether or not they've been using a piece of equipment or I could tell you, you know, that if it's available to move. So we've been utilizing telematics for about eight years, and my utilization is up twenty five percent.

Is that from just people knowing that it's being tracked, having that kind of culture of like, hey, we're a data driven company now?

It used to be you'd call and say, hey, it doesn't look like you're using that dozer, and they go, oh yeah, we've been using it and I really need it bad next month. And then when you'd run the meter reading again at the end of the month, they put two hours on it.

Now I go Hitting back behind a dirt pile.

Hey, are you using that dozer? They go, yeah. And I go, in the last two weeks, you put two hours on it. That's not utilizing it.

They go, oh, you could probably have it. We could get away with it for without it for a few weeks. Okay, great. So I think it's, you know, being able to tell them exactly how much they're using it or not using it.

Right. Right.

And kind of getting that data up, is that something that you report up to your executives, or are there other things that they're interested in other than idle time or utilization?

Well, utilization is a big one for us. We're a zero balance company, so the shop's only money that it has is from utilization.

So it's a key factor for us determining where we're at within the year and where we're spending on fuel and so utilization is a big number for up in our c suite.

A lot of other stuff that'll come up in there is you know how much fuel are we using, how much are we putting in trucks versus equipment, What state is that where we're pumping fuel? There a lot comes into play with that, which is old stuff that was hand tracked before and now it's a report within a matter of minutes.

Got it.

Excellent. Excellent. Yeah.

And moving on to kind of metrics or why metrics matter to executives. So, and executives are standing here for anybody that needs to make those decisions for your company. It may be the fleet manager or you know, it could be on up to your C suite, but at the kind of base level metrics allow you to identify risk and predict growth or scalability. So we need to identify and address operational vulnerabilities. That's the biggest one that we want to make sure that we can control everything that can be controlled.

And a lot of times things are happening that if you're not tracking them, they they never show up, and so you may be losing money where you don't even know you're losing money, and for a lot of companies, that looks like just not making as much money as they could be or being just slightly less efficient than they should be, and then cost, so tracking inefficiencies and reducing waste. Again, controllables should be controlled, and the only way to do that is by tracking them in with data, and then being able to measure the impact of the investment, whether that's, you know, telematics for bill or whether that is keeping a really tight eye on renting for your situation, whatever that situation is, being able to measure the impact and then compare it.

And then growing and scaling. So everybody here managing fleets, it's we need to manage aging fleets. We need to manage size of fleets. We need to make sure we have appropriate equipment.

Having that growth and scalability tracked and influenced by data driven decisions will greatly increase the kind of efficacy of your expansion.

So, Bill, as far as that goes, can you share an example of just decisions that you make based off of data that you weren't able to make before?

Yeah, no, I Some of the stuff that has turned up we weren't able to make before. Talk a little bit about GPS and machine control.

We spend a lot of money on GPS machine control.

They said they were using GPS machine control and then we started being able to pull in the data that showed us exactly how much they were used to that.

And some jobs were overwhelmingly utilizing it and we could see it and other jobs were not. And so we would talk to them and go, hey if you're not going to use the GPS and the machine control then you have the wrong machine because that machine is seventy thousand dollars more expensive because of that.

Let's switch you out of this if you're not going to utilize it and they go no no no we want we want it. Said well I can see exactly how much you're using it. Let's focus on getting it on there and getting it going and that helped us show the crews that out there that were utilizing the equipment correctly that helped us get more return on that investment, and our GPS control is much more used today than it was four years ago.

It sounds like you guys have kind of established that.

Think from what I've heard from other customers is that once you get through the growing pains, it kind of establishes that culture of accountability of knowing that not that Big Brother's watching, but that things are being tracked and that they have a real influence on that, and that they also have access to that data fifty Yes.

And I think one of the things that can often be overlooked is that not only do we need to get data up to executives for them to make decisions, but decisions start in the field. It's the guys' boots on the ground that are actually doing the work that can make the biggest impact on that, and making sure that they have availability to a lot of that data, and reviewing that with them as well is equally as important as getting it up to your executives, because by the time the executives see it, it's already happened, and you know, there's a lot of stuff you can kind of cut off early.

So we have a thing that came up for us is that with all the new generation of emissions on the equipment that's out there, there was a flux of, you know, when it's doing a burn, what it's doing, what the dash is doing, and we were having a rash of having to send mechanics out to figure out what was going on or call the dealers to come out and, you know, enable a burn to get it to go.

And we were able to go through Equipment three sixty and pull up all of our data for repair to exhaust and realize that we had an issue that we had to track and we were able to fix that with some training with our guys in the field.

And I think when you could tell your executives that we saw a trend with our data and we're able to put a plan together and train the guys out in the field and see how much it goes down and how it worked.

They liked that.

Yeah, and I think that that's a really important call out there, that being able to surface a problem that you wouldn't have been able to do that just through paper written work orders, and whether it's Equipment360 or any CMMS system that lets you do detailed cost accounting, being able to tie a return on investment for, yes, this is an issue that we're having with exhaust compared to, you know, this is kind of the expense that we've paid for either the system or whatever processes that you guys have in place, and kind of make that direct correlation. That is something that I think that's really powerful, being able to justify investment.

All right, and I think we've got one more poll or another poll. Aaron, thanks for kicking that off, and we'll give that about another thirty seconds.

This one's a little bit more tightly split. It's not any one particular challenge.

Great. Thanks, John.

I see there's a decent number of people that aren't tracking much data yet, and that is not uncommon.

There's also a decent number of people that have difficulty aligning metrics to business goals, and I would say that whether it's in fleet management or product management, it's the same problem that we have when we're figuring out what to build for you guys, is knowing the why of what you're doing. Knowing the business goals before you figure out what you want to track, and that will definitely influence your ability to track not only the correct things, but to make sure that you're tracking the correct things tied to desired outcomes.

So, just keep that in mind as you guys are making your journey. For you guys that aren't tracking much data yet, just make sure you understand the why and kind of what you're doing and use that to influence your decision making.

All right, preventive maintenance, kind of the meat and potatoes of fleet management.

If you can do this right, you're more than halfway there, I think.

So preventive versus reactive, staying ahead of issues, the biggest thing there is predictability.

Basically, if you're running a reactive repair shop, you are running an unpredictable cost, and that is something that's very hard to grow a fleet or a business, is combating constant unexpected costs.

Reliability, so outside of the machines, we're looking at lost revenue from job downtime as a result of equipment downtime, especially for a lot of our smaller contractors.

That one machine may be the one machine, and that can stop a job and stop work.

And then just the cost, again, cost of unplanned downtime, so it's loss of productivity, repair costs are usually higher after stuff breaks, and then disrupted operations, you know, we're having to maybe rent something, we're having to go source something from somewhere else and truck it.

There are any number of things that can cause problems there. So kind of the goal of preventive maintenance and kind of the preventive culture and fleet is to minimize those disruptions and maximize asset life.

So Bill, at ACTIVE, are there any particular KPIs or strategies that you employ to kind of keep a pulse on preventive maintenance? I've heard a bunch of different things from a bunch of different customers. I'm curious what you guys are doing.

Well, preventative maintenance on that, our services are high up on our target list. I look at my dashboard on a daily basis to see how many services are due and whether they're in progress or not.

The worst thing that, you know, one of the things that you'll deal with out in the field is that, you know, you wanna do the first part of a diagnosis is take care of any maintenance items that need to be taken care of, whether that's filters or, you know, cleaning or something and have a machine go down because filters weren't changed. It was behind non preventative maintenance. It didn't have a service done where it was supposed to. It's probably your worst that you could deal with because it is very preventable. So doing our services is the number one category that we deal with.

And so that when we do have a problem, it's not a maintenance related issue.

So. Got it, so you guys are kind of controlling it by keeping those controllable costs as low as you can. You know, everything's gonna break eventually, but it shouldn't be because of something preventable.

Absolutely, so we target those, we go after that.

We have some inspection programs that we go through some of the gear every year. We do annuals on our over the road fleet that we do. Everything else is based off a meter.

But so and we'll run off of a meter whether it's hours or whether it's odometer. There's some of our services that we target is on a yearly because it, you know, doesn't get a lot of use during the year.

But that's one of our main targets. And then if we do do, part of the other thing about having a maintenance management system is that you can make a repair to a machine that's to get them running and then order the parts, order the stuff to make it a complete repair, but you got to get back to it. And our maintenance management program helped us show that there was still an open work order against that machine, and that we had parts, and we needed to target where it was, you know, a machine was down and available so we could make the repair, so it was available to run when they needed it. So we target a lot of that stuff through the maintenance management data we did not have before. Got it.

And of those things that you guys are, that you're tracking at your level, which of those, like do any of those filter up to your executive group?

So the executive group that I deal with watches my base numbers.

And if I'm above or below on anything, they'll question those. And at that point, I need to know why I'm high here, why I show this here, you know, what has been going on, and I think that when they ask those questions and I have an answer and I can show them the data, they feel like it's being managed and in control.

Got it.

Yeah, and so there's a bit of trust there, that like they know that the right things are being tracked in the right ways, and that if something comes up, we'll be able to measure and we'll be able to have an answer for it. Absolutely. Got it.

Thanks, Bill.

And we will go to, oh, the real? And then utilization. So utilization is the, maybe it'd be more accurate to say if preventive maintenance was probably the meat, utilization's probably the potatoes.

Everybody strives for the most utilization possible, so we want to make sure that we have, and utilization for a lot of companies isn't just hours worked. It's a lot of times that, you know, because there's such a thing as overutilization. You have an undersized machine in the wrong job, and so you can have, making sure that you have appropriate utilization and that you have right sized equipment, and so you kind of have that multi dimensional concept of utilization.

And then right sizing the actual fleet so that you're not paying ownership costs on assets that either aren't funding because you have too many of them, or you are paying too much in rentals because you don't have enough owned equipment.

So there's a couple of different things there to consider, you know, especially from the operational side.

And really what striving for is to make every asset that you employ count, whether, you know, for most people that means generating revenue or minimizing costs depending on how you're set up, but really, Bill, how is, just kind of looking at the tools at your disposal and what you're tracking, how has monitoring that utilization just impacted some of the decision making that you guys do?

Well, I mean when it comes to utilization, we used to have these big ballparks, you know, that was like, if we're using it this much a year that's good you know. Yeah that doesn't get used that much.

But I've been able to you know target that stuff specifically for groups you know three fifty class excavators should be getting you know, dollars eleven hundred a year. Loaders should be about twelve hundred dollars a year in these applications. We should, you know, and the biggest thing that I don't like to go out and buy is equipment that runs five hundred dollars a year because you have to raise your calculated hourly rate so high to make it pay for itself that it's hard to justify owning So, you know, when they get below that five hundred hours and we target each specific one so that I can go look at a job and say, you're way below your standard utilization that we should be having over the last month. You know, what's going on? What can we do? Can we change it to a different machine?

And it also makes a difference when we add to the fleet. So should we replace a one hundred sixty with another one hundred sixty or should I buy a two hundred? Well we use the 200s a lot more than we do the 160s and if it does the same job let's just use this data and say it's much more popular machine we'll run it more hours a year than we will the other Let's push that forward. So it helps us determine getting the right size or the right machine in the fleet and deciding which machines are the right ones that we utilize enough to purchase new and keep our fleet in its mainline operation.

Great, thanks, Bill.

Just from a utilization standpoint, if you had to pick just probably the most significant impact that that has made for you, what would that be?

Would say that our utilization and the improvements we've made in it has enabled us to keep our rate calculations lower than some of our competitors in our market because we target getting so many hours a year on each of these pieces and targeted getting that usage and do we We do rent during the peak times of the year, we're doing way more than what we could own.

So, but during our offside time of the year that, you know, that's when you let all that rental go back. So you grow during that peak time of the year, we utilize rental and different companies to assist you with it.

And then you're just paying attention to your stuff that you're getting complete utilization on it. And it also helps me with the rentals in the fact that I say, Hey, I don't think you're getting enough hours to warranty having it out there.

And they go, you know, you're right. I think we're gonna use another machine to take care of this. Let's get rid of this machine and we'll bring one of ours own in in a month.

And so that's worked quite a bit. My dozer utilization has gone up because of that.

Excellent. So having that real clarity on what utilization or what your actual utilization is lets you kind of temporarily grow and strategically use rentals instead of kind of using them reactively. Absolutely. Excellent, excellent.

All right, I think we've got four total surveys. This is the third one. I know I keep springing them on you guys every couple of slides, so we're gonna shoot this one up there real quick.

All right.

Looks like we've got some opportunities for improvement on how confident you guys are with the accuracy of your fleet data.

We do have a couple of you guys are very confident. That's great to hear.

The somewhat and not very confident, pretty common, actually.

Those percentages represent about what I end up hearing when I talk to customers or we do implementations and things like that. So don't feel like you are in this spot by yourself and having struggles that are unique to you. I will say that one of the nice things about fleets is that most of you guys do things similarly and most of you have the same problems. So, we'll get through some At the end of the presentation, we'll have some contact info up. If there's anything that you guys have questions on, or I would encourage you to use the Q and A at the end of the webinar, Feel free to throw them out. I'm always happy to talk to anybody, customer or not, so anything that comes out of this, if you have any questions, feel free to reach out and we can chat about it.

All right. So kind of moving on and moving away from the off highway side and taking a look at the last couple of slides for me, driver behavior, and this is gonna be predominantly facilitated by having a telematics system, and so that could be, and really, when you look at driver behavior, the biggest thing that people think of is scorecards.

Scorecards are a big part of it, and I think that they make consuming that data easier, but they're not the end all, be all. A lot what goes into driver behavior is creating the culture of safety, saying like, Hey, we are tracking this. We do want everybody to be safe. Everybody needs to go home at the end of the day.

And again, we kind of see that in the slide there, just having that culture shift. We want any of our driver tracking or behavior tools to be empowering the drivers or exonerating the drivers and making sure that they are doing their jobs and operating company equipment as safely as possible.

And so to that end, I wanted to ask Bill, are you guys using any scorecarding or behavior solutions, even if it's just alerting?

So we use alerting. We've been using telematics for about eight years. When we first put telematics in, we had a huge push that was, you know, big brothers watching, you know, you're trying to make sure, you know, what's going on. And it's like, no, we're out there we want to know where the trucks are we want to know if there's you know something's going on or if it's down on the side of the road I want to be able to get to it I want the data to come back if it's kicking a fault code You'd be surprised how many people will drive their truck with the dash all lit up saying, you know, check engine and they just keep going. But and so they were all kind of worried about that in the beginning and then I would get a call that said your driver, you know, break checked me and ran me off the road. You know you at every one of them that calls is in.

You know, erratic, this kind of crazy that this just happened to them. And I go back and look at the data out of my telematics and I see that we were below the speed limit. We had no hard brakes. We had no hard turns. We had no hard acceleration, which is not at all what the person on the phone described.

So that point, know, we'll call that driver and say, Hey, did you just have something that came up and they said, and they'll tell me, Oh, yeah, I was in here and they jammed in and I had to scoot over and they were flipping me off and I go, Don't engage with them. Just let it go.

I'm looking at the data and I don't see that you did anything wrong. But you know, always drive respectively. Always you touch the bases on all the safety items with them.

And it's become more of ninety percent of the time when I get a phone call from a driver's behavior in the field.

It's justified that my driver wasn't wrong, that it was somebody else having a bad day.

And sometimes it shows up that we were in the wrong and that's a different discussion, but.

Yeah, I bet.

I imagine most of the time, like, you kind of see that as the, that kind of culture shift away from, Oh, you guys are just sitting here watching what I'm doing every day, to, Oh no, this is actually going to keep me out of trouble.

Yep. We had the same thing when we went to our over the road trucks and started adding dash cameras. Yep. They everybody was all wound up and didn't want the inside camera because they didn't want anybody to see them.

And then all of a sudden they see that the data from the dashcam is actually protecting them. Right. You know, they see that somebody else did something wrong and it shows on the dashcam. And if they had the inside one, it would also show that you know, they weren't on their phone, they weren't, you know, lost in thought someplace else. And so most of them have pulled the inside dashcam cover off so that it's autumn when they're using it now.

Yeah, and we've seen that on, we saw the same kind of paradigm shift when we went from no telematics to having plug in devices. Nobody wanted to be tracked, and now they're seeing the benefits of, okay, well, yes, there is a culture of accountability. I have to watch utilization. I have to watch run time. I can't use my truck as an air conditioner, all that stuff, and then now we've kind of got to it where everybody expects it and they know that it's, you know, they charitable considerations when it comes to like what you guys are using it for. We just want to make sure that the assets are being used the way they're supposed to be used and that you guys are being safe. And I think we saw the same thing with dash cameras.

And you know, when we first did telematics, I went to our insurance company and I said, If we start doing telematics, will that give us a break on our insurance?

They said absolutely. And so then we started doing that and the companies that would, you know, bargain to try and get in with active every year when our renewal policy come in, they saw we were using telematics. They saw that we moved to dash cams. That helped us now. And now one of the questions they're asking about is driver support charts, insurance companies, want this stuff, and they're gonna push it.

So it's coming down the line for a lot of people.

Yep. Yeah, and I think that that's an important thing to, as you're starting to look at adopting technologies, is kind of, You have to do it for operational security and efficiency, but I think there's also that human element that you need to consider how a lot of that stuff, how a lot of those guys feel about it and how it impacts them, and make sure that there's a good story to tell about how it helps the organization top to bottom, and I think that's where a lot of my customers have seen the most success is, and HSS has always had a field first kind of philosophy because that's where the work is happening, but yeah, that is one thing that I would challenge anybody to just remain cognizant of, is that if you can get the field bought in, the rollout's going to be a thousand times easier. Doesn't matter what it is.

Yep.

Great. And then I think, Aaron, we've got, let's see, oh, no, sorry, one more slide and then we've got our last poll and I'll hand it off to Mikayla. So fuel costs, so other than the equipment itself, and fuel is probably your largest controllable expense in a fleet, and it's probably the most important one to keep a vigilant eye on is, you know, where's the fuel going is the big one, and then identifying waste. So a lot of that is idle time is not only part of the machine, but it also waste fuel, And then being able to kind of translate that, and fuel is one of the easiest ones to translate that, or to do an ROI calculation for, is if I can change idle time, I can decrease fuel consumption by X percent, that will save Y dollars, and those from an executive level, that direct correlation, being able to say, This is exactly what we saved based off of this investment, is huge.

Bill, have you guys had any, or what's your experience been with just kind of having that visibility into the fueling operations and consumption?

So we fuel all our own equipment. So I have two fuelers that run two different directions every day. They touch our gear, they fuel grease, do services out there.

And before when we were doing everything by paper and excel we would calculate our fuel rate based on the size of the tank.

So if you had a hundred gallon tank, it was made to run for a ten hour day. So you're burning ten gallons an hour.

But now through the telematics programs that, you know, a lot of your equipment comes from the factory on, You get. You know, down to the quarter gallon that you're burning. And so you can go back and look at your average fuel rate now and, it fits, you know, much different and all of it is on the newer equipment compared to the older equipment.

And you don't have to track that as much because you can just go look at it and pull it into your calculation.

And also you could pull that data out for the whole fleet and compare classes and see which machines are actually getting better fuel burn than others.

And those may be machines that you want to target for the future to add to the fleet because fuel cost is seems like it's always on the rise. So And then we do track based on how much we pump at every job.

So on a daily report comes back from my Oilers that tell me exactly how much they're pumping at every job.

You know, it's a burden my behind when I look at it and see that someone drove forty five minutes to a job and pumped twenty five gallons of fuel. It's like, know, hey, I just spent an hour on, you know, twenty five gallons of fuel. Do you realize how much that really costs per gallon? So, yeah.

So we track each one based on how many gallons and I could tell you how much each of our jobs are actually running equipment.

And I target those for utilization also, so.

Are you guys using, I'm assuming you're using that for looking at that ahead of time, you know, like that example you just gave to say like, hey, maybe go out tomorrow instead.

Skip doing every other day. If you guys are like twenty five gallons a day, let's hit them every other day, and then, you know, we're pumping fifty gallons, and then everything's getting greased or not. So, yeah. Right on.

Thanks, Bill. We've got one more poll, and I'll get Aaron to kick that off, and then we'll kick it over to Michaela, and Michaela is gonna kind of walk us through quickly what that looks like to take that data into a centralized platform and what that could look like, what kind of insights you can get out of that.

Excellent, asset utilization, biggest one that is pretty consistent. Interestingly, fuel and maintenance probably would have been the second and third highest three or four years ago, and I'm seeing driver safety and behavior, or driver behavior pop up there, and that's kind of just, that shadows kind of the times, and how much of a focus that has been, not only from a safety standpoint, from an insurance standpoint, and from just an overall technology standpoint. You know, the technology that we have today, we didn't have the capability to do a lot of that stuff four or five years ago, and I think that that's one of the things that the construction industry does not get enough credit for is that it tends to be pretty tech forward as soon as the technology gets there.

And so, that is right in line with what I would expect to see.

All right, I will go ahead and kick it over to Mikaela for the next couple of slides.

Yeah, thanks Phil. I fully agree with what you said too. I think that our industry tends to be a little bit reductionist of how much we do. The technology in this industry is pretty phenomenal and exciting.

Speaking of exciting things, we have a tool at HCSS that's free for our customers to use. It's interesting to me that one of the polls, twenty four percent of you on the call believe you're not doing any data collection. I'm here to prove you wrong. Hss does that data collection for you, in a tool called HCSS Insights.

In fact, the tool that we've used, it's free, for all of our customers. It runs eighty five out of the box reports that are built on top of Power BI. And so anything that is entered into HCSS products, Equipment360, Telematics, is pulled into Insights. Then we've built reports for you to make sense of that data.

It's really great if you want an out-of-the-box reporting solution that's already ready to use. You don't want to have to do any setup. You don't want to have to be building any reports yourselves, hiring data analysts, all these things. Don't have to configure anything.

It's already ready for you to get set up.

If you're working across multiple products, HeavyJob E360 Telematics Insights will give you one view across all of them.

And if you really like that pre-built report feature, you can tweak those things to accommodate whatever needs you have on the reporting side without building it from scratch. It's going to save you a lot of time. It's going to help you make faster decisions.

So that's one thing to note about insights. This is who it's really going to be useful to. Next slide, Phil.

What makes insights powerful though, is we have the ability to do calculated fields.

And so what that means is that we're able to do, to combine the existing workflows into more meaningful metrics for you so that you get a little bit more actionable data.

Like I mentioned, we have over eighty pre built reports on fuel costs, equipment utilization, maintenance expenses, work orders, driver behavior, safety, all this kind of stuff. I'll show you a couple of them in a second.

So this makes things really powerful, combined with the fact that we can also do hourly and daily refreshes to keep your data very current. So you can see what happened an hour ago. If you get that call from the field, you're able to see what's actually going on and pull up that report. So whether you want maybe work orders, track trends over time, you can do it all right there within Insights. Next slide.

Like I said, Insights just came out too a couple of months ago. It's been in beta for a while, but it's designed on top of Power BI, the world's fastest and most commonly used reporting solution built on Microsoft Power BI. Next slide.

Like I mentioned too, it's free to use. As long as you're an HCSS customer, this is available out of the box.

It's bundled in. You can start using it right away. If you are an HCSS customer and don't know if you have this turned on, you need to be an admin and it's easy to turn on, write in credentials. I'll show you how to do it.

Next slide.

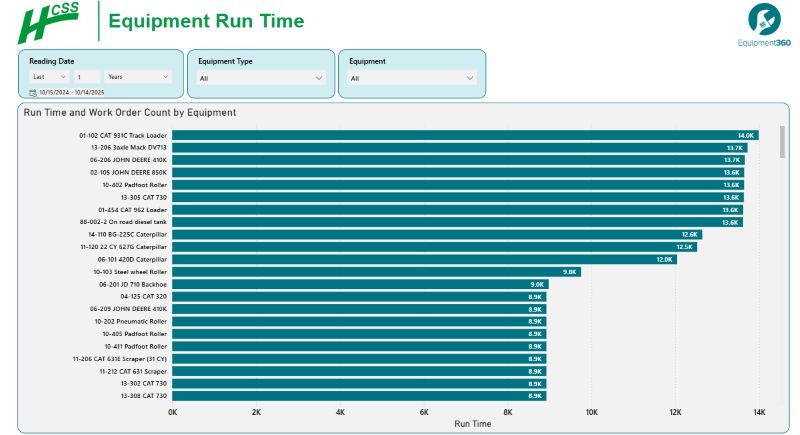

Give you a couple of examples of some of the reports we already have in here. Shifting to E360.

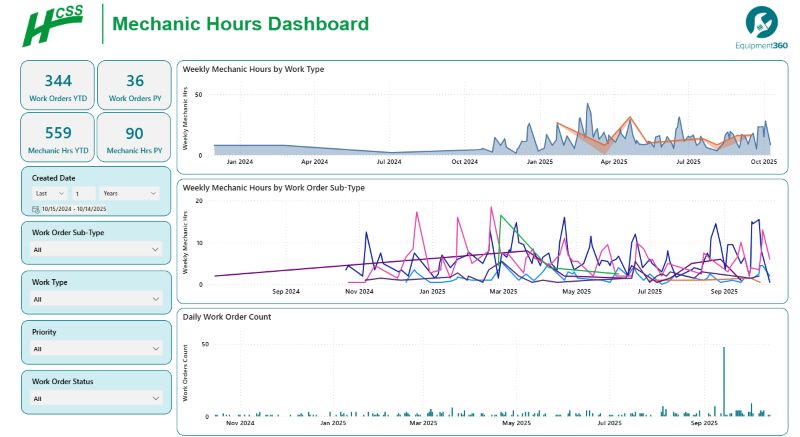

This report, Mechanics Hours Dashboard, is really geared towards fleet shop managers, breaking down, like, how your mechanics are spending their time, what services take the most time. Are they working on equipment in the shop, in the field more? How long does it take for them to travel between sites? Are they spending more time on repairs, traveling different tasks?

This report really can help you pinpoint inefficiencies, reallocate resources where it matters the most, and really get a full picture of what your mechanics are doing on a day to day.

Next slide.

This one's cost by equipment. So we built this one to answer some cost questions, mostly like what equipment or equipment cost the most to maintain, what types of repairs drive the highest expenses, and you can drill into different part costs too. So is it brakes, tires, fuel, AC, engines, what's costing the most?

We can even track down costs that are related to misuse so you can address things that are more preventable before they pile up and become a bigger problem. Next slide.

Last report here that I want to show off a little bit, work order trends. So we can see here, like the cost by repair type right down to the item code and identify what components keep people the busiest. We can look at whether preventative maintenance is taking longer or is taking enough priority over the repairs or if we're still spending too much time fighting fires.

And then looking at trends as well. What days of the week do our work orders spike? We can plan to staff better, get ahead of the curve, and make sure that we're staffed up.

Next slide.

Here's just an example of another one of those reports, equipment utilization report here, where you can drill into change the different filters for what accommodates your needs, and really pull those answers out of HSS products depending on what it is you're looking for. Next slide.

E360 data, it will be available in Insights end of Q3. But if you don't have insights yet, you can get started with it today for free. It takes about five minutes to turn on. I'll show you how to do that.

Next slide.

If you want to screenshot this, pull out your phone, take a picture of it in case you want to go and get it done right away. You have to be a company admin, but in HCSS, if you go into HCSS credentials, there's a tab called groups.

You go in there, select Insights, and after ten minutes, the dataset will provision, and then you are able to get your login to Insights. It'll email you directly, and you just click the button that says login.

And that looks like this. Next slide.

So right there in credentials tab that says groups, you select Insights. Once you select it, next slide, You'll get an email that'll pop you into insights. It'll tell you to select your roles. So different types of roles.

We can create reports as an add on, and, subscribe other people to reports. You pretty much have like the God view of insights. A designer can create personal reports for themselves. A reader can only You can still have access to consuming these reports, but you have read only access to the reports.

And then you can also define a custom role in case you have some of these one off scenarios where maybe someone needs to be a designer on one report, but a consumer of another or an admin of another. You can create roles like that as well.

After you've set your permissions, you go and assign different accesses to different reports under the the Insights tab. And so all of this will be walked through once you get your first login to Insights as well. So it'll it'll next step you all the way through it. You don't have to remember all of this.

But essentially, no matter what access you select on different reports, it's customizable. And so if you need your upline to be getting these reports, your C suite to be getting certain reports, or you need the field to be getting certain reports, you can subscribe them on a different timetable so that everybody's getting the right answers in their inbox at whatever cadence you set.

Next slide.

When you first log into insights, it'll look blank. So you have to go over here to set up and manage your report templates. And like I said, this will all be explained in the product as well. There's walkthroughs that'll show you exactly step by step how to get everything up.

But if you wanted the equipment work order summary or if you want your equipment utilization or mechanic hours dashboard, those are all in a list and you just assign it to your company. Then five minutes later, it's there in the environment for you to be able to preview, subscribe, edit however you want. Next slide. I think that might be my last one.

Yep, that's it. Back to you, Phil.

Yep, thanks, Piko.

Takeaways for this last fifty minutes.

Really focus on essential metrics. Like I said, most fleets are managed or have the same problems, you know, because we do the same stuff. So, focus on your biggest controllable costs and your most impactful areas of influence, utilization, fuel, maintaining a good preventive maintenance culture and driver behavior.

Figure out what business outcomes you're looking for, and then use that data to influence those decisions.

I think tracking the right metrics can be a huge, or have a huge impact on reducing some of those unplanned things. You know, that puts you in a position to be more proactive instead of reactive, and then after you get those in place, tweak your reporting, tweak your metrics, figure out what is impactful for you and what you need to track and what you need to report up. That said, I will just wanted to thank Bill and Mikaela for joining me today. I think we've got a couple of minutes left for Q and A if we had any questions.

And again, the contact information is up there. If you guys have any questions at all for me or any of the other speakers, feel free to reach out. I can't speak for Bill and Michaela, but I love getting emails from anybody, customer or not. If you have any questions, I'm happy to email you or hop on the phone and chat for bit.

Well, that goes fully for me too. Please reach out if you have any questions.

Yes, thank you so much for the presentation. We do have some questions coming in, and just a reminder for everyone to submit the questions in the Q and A below the screen share. So the question is, if our fleet consists of several equipment manufacturers, does HCSS Telematics accept the telematics data from all major equipment manufacturers?

We do. We accept, so all of your big ones, everything that you mentioned there, cat, deer, kamatsu, down to some of your aerial equipment, Skyjack, Nifty, Lift Genie, things like that, all of that stuff, we will integrate with those, and depending on which third party providers, we still we integrate with some of those, too. If you have, you know, same SAR devices or we're working on some others down the line, we can pull all that in.

Great, and the next question is for Bill on usage of HCSS Telematics.

Oh yeah, I think he's just asking if you're using HCSS Telematics, yeah.

Yeah, we've had it for about eight years now.

Awesome, yeah, so feel free to type in your questions while we have all our speakers here, or, you know, scan the QR code if you have any follow-up, or you would like to speak with any of them later on. But we're gonna give it a few more minutes for folks to submit questions here.

I would go ahead and say on that telematics question is that I do use HCSS telematics but I also use all of my OEM providers. I just have them do an API pull so that I have all my information in one place and then if I get some stuff that's like technical, I'll go to the OEM provider and chase down data codes or something going on in there if I need to chase it, but HCSS does pull in everything for me.

I think Joel had one that you might have some insight on, Bill. Where to start in terms of what to start tracking?

What start tracking?

Utilization is what you wanna target is your first thing for getting it out there in field because when you're tracking utilization, you're also putting your hours in for your services and being up on the preventative maintenance that you can be preventative on.

It helps you target those goals for utilization you have on equipment out there. It helps you explain to the fleet out there what we need out of those machines that are out there. And then if you went into a maintenance management system some of this stuff is that we went from just repairing stuff every day, you know, to repairing stuff every day, but it's on a work order. And now I can track it based on whether that repair was a hydraulic repair, whether it was a drivetrain repair, whether it was an engine repair, whether it was exhaust or many other things that I have in there. And then I'm able to go back and target my largest ones to see if there's anything I can do to try and reduce that cost, which is where we ran into the stuff with exhaust and our DPF burns.

We've run into it with our undercarriage on dozers. We've changed our inspection program so we're able to target that so we don't have downtime when it comes to undercarriage. You have to get started and then start pulling it apart and look at it. But those are all the things that I would go after.

I would add to that too, like start with the questions that you have that you want answers for and see if I mean if you want just something really, high impact, low cost to start, give Insights a try, see if it can answer those questions, and then take yourself from kindergarten to elementary school to high school, get your grad degree. Like, asking tougher and tougher questions and keep going at it in different ways and trying to get those answers from different systems.

Great, thank you. I think we have time for one more question. Are there any thoughts on multi person time cards for E360? For instance, a head mechanic accounting for text time as well on one time card, Can this be developed or is that available?

That is actually something we're talking about internally.

Anything can be developed, but we are looking at how we would do that and some of the implications of it. So no firm answer, no yes or no, but we are talking about it internally.

Sounds good, very promising. Can data collected with HCSS Telematics be summarized by Project SCOPE and incorporated into future estimates, that are executing similar tasks to establish a baseline?

Doctor. Yes, so we do. Everything is tracked at the job level, or within a geofence is how it's tracked. So you can take that data and come up with, say if you wanted to use fuel burn and come up with an actual like, ownership cost estimate or operating cost estimate, excuse me, to use in your bid application or whatever you want to do there, you can do that. That data is available and we can generate those rates to push back so that you're not just using Black Book rates or guesstimates.

Sounds good. Well, it looks like we're heading the one hour mark. I would like to thank everyone again for joining today's webinar, And, as mentioned before, we'll be sending out a recording of this, webinar. And if you have any questions, you know, feel free to reach out the speakers, by scanning the QR code or emailing them. And thank you again for a wonderful presentation and webinar today. Have a great afternoon.

Thanks, There's one more slide.

Oh, this is just a little plug for us at HCSS. We do a quarterly release, and this is where we will inform you guys of all of the new products and features that we will be releasing, and we do it every quarter. So if this kinda piqued your interest about Fleet and Insights, feel free to scan the code, and you can register for our next quarterly release, which is gonna be August twenty-sixth, and this will be the Fleet one. So hope to see you guys there too.