Margins in heavy civil construction are tighter than ever. Rising material prices, labor shortages, and safety requirements all create added pressure on contractors. Decisions such as whether to self-perform or subcontract can make or break profitability, especially without real-time cost visibility.

In a recent webinar for Engineering News-Record (ENR), the panel consisted of the following HCSS product experts and construction industry professionals:

- Andrew Fowler, Senior Product Manager for HeavyJob at HCSS

- John Cappello, Senior Account Executive at HCSS

- Melissa Mott, Lead Specialist for Project Controls and Audits at Rigid Constructors

- Bill Oberlander, Senior Estimator at North Star Group Services

The discussion centered on how contractors are using software, field data, and stronger processes to overcome today’s challenges. Let’s dive into the key takeaways!

The biggest challenges in heavy civil construction

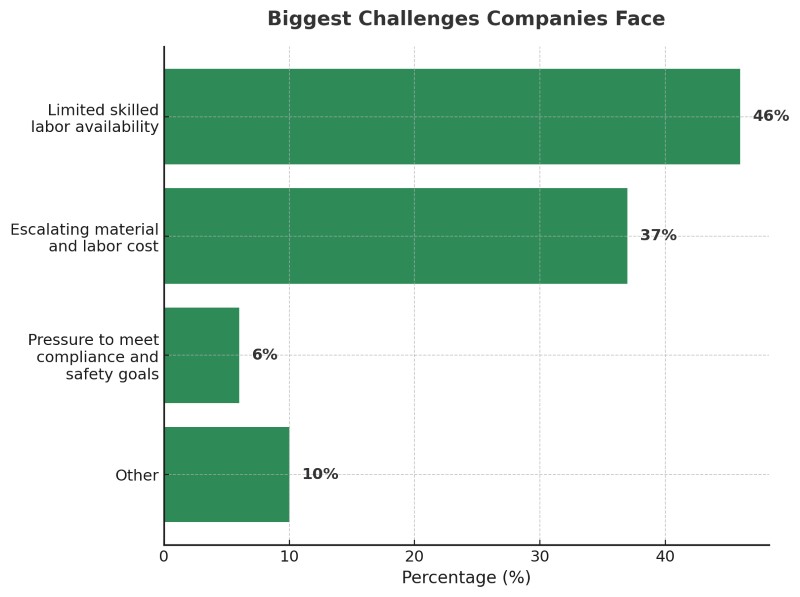

The webinar opened with a poll asking participants about their biggest challenges. The top two results were not surprising: limited skilled labor availability and escalating material and labor costs.

“We really struggle with the limited skilled labor availability,” Bill Oberlander stated. “We are in the environmental industry, environmental remediation. There are some definitive skills that we’re looking for, and we work all over the country. When we move into a new area, we try to get as much local labor as we can. However, many of the sites that we work on are remote. We’re seeing an increased cost that we’re facing just to work with that limited skilled labor availability.”

Melissa Mott, speaking from her experience at Rigid Constructors, highlighted the ongoing challenge of finding qualified management- and superintendent-level employees. She noted that recent turnover in those roles has made staffing particularly difficult. This issue becomes even more critical when trying to assign personnel to projects that were bid months or even a year earlier, as changes in labor availability and wage expectations can significantly impact project planning and costs.

Even as costs rise, contractors face the challenge of differentiating themselves in a low-bid environment. Oberlander noted that relationships and problem-solving are critical beyond just answering an RFP.

“The best way that I’ve found is to get involved with your client,” he advised. “Follow up with your client. Really dive in and figure out what they’re trying to solve and provide unique solutions.”

In other words, long-term trust and creative problem-solving can help firms move beyond being treated as a commodity.

Data as the financial blueprint

Accurate estimating and job costing form the financial backbone of construction projects. Oberlander described the importance of historical production data. “I look at estimating and job costing as a big circle,” he said. “One feeds the other, and then more accurate and historical data goes back and rolls into estimating. The better the estimate, the better the job costing blueprint.”

Oberlander also emphasized that both man-hours and dollars are vital lenses, observing that production rate costing is timeless. “It doesn’t matter if materials have increased, equipment rates have increased, labor rates have increased. If you can do so many units per hour, that’s a standard.”

On the project controls side, Melissa Mott highlighted the value of strict auditing to ensure clean field data. “We are actually strongly pushing and auditing the information that our field guys are putting in,” she said, noting how they run and look at reports and time cards every day. Her goal is for upper-level management, including project managers and even the president of the company, to be able to quickly review a daily digest and immediately understand the progress made on-site each day.

Her approach includes requiring explanations for zero production entries and building transparency through tagging. “We want to make sure that everything being put in can be looked at without picking up the phone and having a phone call,” she adds.

Building accountability in the field

A recurring theme in the webinar was giving field crews the tools they need for success. As noted, this changes organizations for the better by creating results, because nothing happens in construction without field workers.

Mott shared how ownership has flipped the accountability model: “Historically, the company hasn’t pushed that ownership down to a lower level. Because they’ve gotten that tool, now they have jumped on board and hold themselves accountable. When you give someone that ownership, they run with it.”

Even seasoned industry veterans who willingly joke about themselves being “the old guys” are beginning to adopt new technology. Some who previously relied on paper time sheets as recently as a few months ago are now actively using digital tools and adapting to modern software systems.

How often should you review job cost data?

Another poll asked attendees how frequently they review job cost data. The majority answered weekly, followed by monthly, with a growing minority doing so daily.

Mott emphasized the advantages of a multi-layered reporting cadence. Monthly reviews drawn from a company’s ERP system offer a comprehensive look at performance. Yet weekly check-ins, supported by data from HeavyJob, serve a different purpose, which is to provide timely, actionable information that allows for immediate adjustments on active projects.

She pointed out that this frequent monitoring helps avoid the pitfalls of delayed problem detection. Identifying issues within a week, rather than months later, enables the team to intervene early, make course corrections, and prevent small setbacks from becoming major setbacks.

Should you subcontract or self-perform?

One major topic of discussion was how to decide between subcontracting work and using in-house crews. Labor capacity remains a top consideration. Oberlander pointed out that it really comes down to whether the internal team can deliver a product equal in quality to what a subcontractor would provide.

“When you pay a little bit extra for a subcontractor, almost all the time it’s well worth it because you are alleviating the risk on your own company,” he commented. “You’re also alleviating the risk on the owner.”

Mott added that job costing doesn’t always tell the full story. Her instinct is to default to the cheapest option, but that approach requires a reality check. Project managers need to be reminded to ask not just “Can we save?” but “Can we realistically do it?”

The takeaway: run parallel estimates for self-performing and subcontracting options. Carefully weigh risk and labor availability, and give project managers the flexibility to make decisions based on the full scope of the project.

From insight to action

The webinar made clear that while rising costs and labor shortages are daunting, contractors are adapting with new processes and mindsets. From daily job costing and field ownership to parallel subcontracting estimates and AI-powered tools like HCSS Copilot, today’s leaders are using data and technology to mitigate risk and complete even the toughest jobs on time and on budget.

If you would like to see how HCSS software can start enhancing your operations, don’t hesitate to request a custom demo from one of our product experts.

Hello, and welcome to this webinar, Navigating Rising Costs, Tools to Scale Your Construction Business. This event is brought to you by Engineering News Record and sponsored by HCSS. Hi. I'm Adam Polan, special sections manager at ENR and your moderator for today's webinar. Thanks for joining us. Margins are tighter than ever in heavy civil construction, and decisions like whether to self perform or subcontract can make or break profitability. Without real time cost visibility, the risk set up fast. Today, we'll explore how top contractors are using software and key reports to stay ahead. Joining us from HCSS, we'll hear from John Capello, senior account executive, and Andrew Fowler, senior product manager for HeavyJob. We're also excited to welcome Bill Oberlander, senior estimator in North Star Group Services, and Melissa Mott, lead specialist for project controls and audits at Rigid Constructors. We will learn about our presenters shortly. Now, I'll be rejoining our presenters towards the end to answer any of your questions that come in throughout the webinar. So don't forget to submit them in the Q and A section of the webinar console. And with that, let's get started. Over to you, John. And so my name is John Capello, senior sales account executive for HCSS. Been with HCSS for thirteen years. In my career, I've talked to thousands of estimators and thousands of project managers. So your problems may be unique to you, but I hear I'm at thirty thousand foot overview on a daily basis. So I'm looking forward to making some contributions to the discussion and asking some questions of our experts. My name is Andrew Fowler. I'm a senior product manager over here at HCSS. I work on our heavy job application that's in our operations side of the business. Similar to John, I've talked to a lot of you, talked to a lot of customers about the issues they face all the way from the foreign in the field up to that president back in the office. So I'm here to add in that side of things of what does it look like globally across a lot of our customers in inputting those types of information as our experts go through and give us their side of it. I'll go ahead and kick it over to Bill. Good morning, everyone, or good afternoon, depending upon where you're at. My name is Bill Oberlender. I'm a senior estimator at NorthStar Group Services. I started in the industry quite a while ago, thirty three years ago, and I've been estimating with actually with HCSS products for about twenty four, twenty five years. So currently, I'm in the environmental industry, but I've also played in the heavy highway, site work development, heavy civil industries, and also owned my own consulting firm that did a lot of estimating and preconstruction advising. I'm the lead specialist of controls and audit with Rigid Constructors. I have been in the industry almost twenty one years. I've done everything that you can imagine from accounting, project management, estimating, assisting in those departments. I've been using HeavyBid for almost twenty years and I've been using HeavyJob for most of that time. I've actually done one installation and came in the middle of implementation on the current job I'm at now. My passion is in job cost accounting. That's what I love to teach, to learn, and to just help others with how we all do it across the country. Alright, so I'm going go through the objectives today for the webinar. We want to share some real world strategies for tracking job costs. We want to talk about how data can influence decisions, and we want to talk with the experts that we have on the line. Only on ENR are you going to hear somebody who has a passion for job cost accounting. But we're going to go through some of those things and see what these experts have to say about contemporary issues. So we're going to kick it off with a poll. What's the biggest challenge you and your company face? Limited skilled labor, escalating material and labor costs, pressure to meet compliance and safety goals, or is there something else that is not on this list? Looks like we're getting a split between two. So a few more coming in. But limited skilled labor availability is taking the lead right now with a close second with the escalating material and labor costs. All right. So I'm going to kick it over to our experts and get them to weigh in. What has been your experience? Bill, we'll start with you. What's your biggest challenge at North Star? Well, I think the poll says it all that limited skilled labor availability and the allocated material labor costs, are right on. Those are the top two. We really struggle with the limited skilled labor availability. We are in the environmental industry, environmental remediation. So there's some definite of skills that we're looking for. And we work all over the country. So when we move into a new area, we try to get as much local labor as we can. However, many of the sites that we work on are remote. They're not available. And not only that, it's just getting getting everybody to the site is difficult. So one of the challenges on the estimating side is the cost of labor when it comes to that, being able to provide per diems and travel expenses and those types of things. We want to take care of our folks, but it does increase the cost. So we're seeing an increased cost that we're facing just to just to work with that limited skilled labor availability. Melissa, how about you? We're like Bill in the fact that we're pretty specific in certain areas of our company. Bridget does heavy civil, marine, and industrial work along with just some standard concrete work. Finding those skilled laborers is essential to a lot of what we do. Another thing that we're seeing is finding management level and superintendent level employees, or we've recently gone through turnover with that, so finding that is important. Rigid tries to stay very competitive with those current markets of paym and salary and things like that. However, when you are trying to put those employees on projects that have been bid a year or six months, you do, you know, the labor availability and the changes in values you're paying definitely makes a difference. With material and labor costs, same thing. We may be on a job that's four or five years old and those materials are going to escalate on you. You're locked in for a contract, but sometimes those purchase orders may last six months to a year, they may last two years with escalators, but when you cross over that three and four year mark, you get to a point that those suppliers can't continue to provide the materials at that price. Definitely both challenges for us and I've also seen that in smaller companies. I've been with Rigid not quite a year and so last year noticed that really strong within a small company of just how important that labor availability was. Well, so we are going to go through some of the, objectively, this is from our information that we have, but current challenges in the heavy civil construction industry. Obviously, we have identified what you can see on the screen, but one of the things that I have always found interesting, especially talking to estimators, is you know, in this world where you have to navigate escalating costs and you have to still differentiate yourself when you are perceived somewhat as a commodity, it gets difficult to do. So, Bill, can you speak to some of the things that you do, some of the unique and creative things that you do within your estimating process to give you some kind of differentiation from your competitors? Yeah, I mean, well, number one is relationships. It is trying to develop the best relationship you can with the client. You know, when you're when you're low bid and you're a rip or read contractor, it's difficult to develop that and you become a commodity. The best way that I've found is to get involved with your client, follow-up with your client, try to meet the need that your client is reaching out to you, but not just answer the RFP, but really try to dive in and figure out what they're trying to solve and provide unique solutions for that. That's probably the best way that we can be a differentiator and to make sure that we're known for our services, not only high quality, everybody strives for high quality and those types of things. Really getting involved with your clients' problems and trying to find a solution base. You know, when the twenty one, twenty twenty two, I would talk to some contractors, usually larger contractors, and I'd ask them how they are navigating increasing costs and those types of things. A lot of times they would say, Well, we have contracts, you know, so they didn't really feel it. Everybody has some kind of issue. The estimating focus. So, obviously, the estimate is the lifeblood of your company. You have to win jobs in order to feed the families that you employ. So can you speak to you can take any of the topics that are listed on the screen and talk about your best practices and how you manage teams and what you do in order to navigate these items. Yeah, that's a great question. Thanks for that. I would say probably out of those three bullets that you have there, the one that I really want to dive into is number three, using historical data and production rates to drive smarter bids. Historical data and production rates are paramount. If you have the ability to keep track of them and you have the structure to do that, I kind of look at estimating and job costing, Melissa is talking about as a big circle. Right. And it's connected. Shouldn't be two parallel lines that get handed off to each other. It's a big circle. One feeds the other and then more accurate historical data goes back and rolls into estimating. The better the estimate, the better the job costing blueprint. Estimating isn't all historical data by any means. Otherwise, we'd just be pricing widgets, right? Everything has a feel to it and everything has an understanding to it. But there's a there's a fine balance between that is the way I look at it. But having that historical data to lean back on and see if you're even in the ballpark Or if you have two years, five years, ten years of similar projects and similar type activities that you've tracked, then you can kind of take a look at that and and say, all right, well, I'm I'm five dollars a unit on my estimate, but my historical is saying I should be three dollars and seventy four cents. What's different? Then you can identify and really hone in on what what are the different types of things we're dealing with here and really have a good grounding on on your estimate accuracy. It is the financial blueprint of of the job. It is the first step. I had a I had a boss one time that said, you're the you're the tip of the spear. You pierce the veil to allow the construction to happen. So you have to be accurate. That's kind of some of the things I look for is I really enjoy the type of work that Melissa does to bring historical data to the estimating side. Yeah. And Melissa, I know you had a unique take on that. Just out of curiosity, though, Bill, when you look at something from a from a preconstruction perspective, do you start thinking in terms of dollars or do you start thinking in terms of man hours? What what immediately pops into your head when you're reviewing a project? I think in terms of both, actually, because they both tell different stories and they're both just as important. Take a unit per man hour report, which you're talking about is is man hours. Right? That is timeless. When you when you take a look at production rate costing, that's timeless. It doesn't matter if materials have increased, equipment rates have increased, labor rates have increased. If you can do so many units per hour, that's that's a standard. But then you have to balance that back against, you know, your actual unit cost rate so you can take in the real world, you know, hit of what things are costing me today. But I look at both, John. I don't think you can look at just one or the other. They're both very important in different ways. Yeah. And Melissa, you know, you've in the past that the information you're collecting at the field level provides that feedback to the estimating. So what do you do to mandate that the folks in the field are going to capture the data that they need so that we can track and make sure that the estimate was realistic when we won it? So we are actually strongly pushing and auditing the information that our field guys are putting in our workers. So we audit daily. Have taken to reviewing different reports. We do use Heavy Job. It's a great tool. I love the reports that are in there that I can audit and set up specifics on. Are they doing their product production quantity entry? Are they, you know, reporting their equipment hours? Are they doing the things like that? And so every day I look at and run a report or look at a time card or search, you know, in my field for proper hours to make sure that not only do they understand the system, because if you do choose any sort of technology, whether that's HSS or whatever product is out there, technology is taking over a lot of ways in construction. And so when you're moving to that, making sure your people understand what they're doing within the technology is extremely important to start and get that data correct. So we do a lot of, we're pushing out training, and then I just audit those things. I want to make sure if you put a zero production quantity for that day, tell me why. You know, we utilize an option of tags and so it says, you know, I can't use this today because it was a rework item or there's no production because we had to fill this hole in. You know, there's just different ones out there. And we want to make sure that everything being put in can be looked at without picking up the phone and having a phone call. We want upper level management or project managers, the president of the company, to just look at that daily digest and see, Hey, I know what they did today. And so what happens is it just makes our data more and more accurate at the end of the day. First off, number one, for that real time information for that supervisor to make adjustments for the next day, but then again for those historical bids and making sure that when they are looking back on the job, our estimators actually do ask us and come to us and say, Hey, how did we do? What can we do different? What should have we done? And so just making sure our employees understand what they're putting in the system and then just auditing and checking what they are doing apart from the normal, you know, most companies, most project managers are going go review their costs. They, that's, I would say a standard in what we do. But I think auditing that, we're unique in that my job is to train and just audit people, check, are you doing what you're supposed to do? And one of the instances that we got into was, you know, the tag and the zero. And I said, I'm not auditing a zero, I'm auditing, are you doing it? Did you really put that production quantity in for that day? And that's important because when you're looking and you're running on a unit cost basis, you know, that production quantity matters for the bigger number. And I said, if you're not doing the little things, the fundamentals, the tiny parts, how am I certain you're going to be doing the bigger things in the job reviews and analyzing at the end of the week or end of the month. Melissa, think that's an excellent example. The audit is something that I've heard at a few companies. I've heard it called the compliance meeting and things like that. My question as a follow-up, how are you instilling a sense of accountability back into your field managers to make sure that that is being done? So our field managers are amazing when it comes to what we've done. I probably have every one of their numbers on my phone. They will call me, text me, email me. They know that they can anytime of the day. I am available to them to teach them, to help them and to learn. And they have taken so much ownership of that. Historically, company hasn't pushed that ownership down to a lower level. So because they've gotten that tool now, they have jumped on board and just they hold themselves accountable. I don't really have to do much. Those guys hold themselves accountable and because they are at their own level, honestly, they're pushing it upward. It's going backwards. Typically, want our, you know, our larger managers and our VPs and our presidents to do the big buy in and we push it downward. We're seeing it backward. And I, from, you know, all the different places of doing what I do, I love watching these seasoned workers buy into something and want to learn and do better and see their cost and put the detail in and make sure everything's correct. It's interesting, but I do, like I said, I do daily audits. I send them an email. I'm like, hey, so and so is missing this little time for today or hey, your hours looked a little off or this looked a little off. I just, you know, I send that straight to them and they nine times out of ten, my phone is going to ring within thirty seconds of that email being opened because they've bought into it so much they want to know. When you give someone that ownership, they run with it. Our guys have. Yeah, it really is amazing whenever you give the tooling down to those the field, it's that field first mentality. It just changes the organization and creates better results across the org because nothing happens in construction without those field workers, right? So if you can get them aligned and get them moving forward, better success across the board. Yeah, and one thing I have told, gosh, I can't tell you how many hundreds of people through my career, I have always made every person I work with for understand my job is supporting you. I don't get a paycheck if you're not out there in the field getting that work done every day. And so my job in probably ninety percent of the roles that I've done in construction are just complete support of, you know, those field guys. I did spend one year on a job site where I was a little more involved, but, you know, even then it was a support role. And so just letting them know, you know, I'm here to support you. I'm here to make your job easier, not make it harder. And I think that's an important thing. Anyone in a support capacity, job cost capacity, account capacity, project controls, all those places is making sure those workers understand my job is support you. How do we get bigger? You know, how do we grow? Absolutely. And Bill, I had a follow-up question for you as well. Concerning that historical data, a lot of our contractors work in regional offices or in regional capacities, say, in the city of Dallas as a good example. And they'll use that historical data to say when the job is on the north end, it is going to be at this production rate versus on the south end versus this production rate because of the the dirt and the the, snowball climate of that. Do you see the same types of things happen whenever you work across a national scope with your current job versus it being more regional in nature? Oh, absolutely. Yeah, yeah, we definitely see a change in production rates or costs in general, depending upon the region that you're working in. There's a lot of factors, in fact, that that change as your geographic location changes. And that's one thing that I've learned a lot since going from a more regional area where I started out in the state of Montana versus going and bidding things nationally. You have you have labor influxes such as you might be in an area where you work with unions. You might be in an area where you have all predetermined wage rates versus local wage rates. You might be in soil conditions or any other type of conditions that are that vary greatly. So, when you're keeping when you're keeping track of those costs, those historical costs and you you get back to the other side of the circle where, you know, Melissa's kept track of all these costs and now on the estimating side, we can utilize that for for data driven estimates. You have to understand where you're at and what those variables are that might change. It's it's not going to be just just because this item costs you X amount per unit here in Texas, as you said. It's not going to cost you the same in New York State. Right? Lots of variables there, just like our beautiful country. There's diversification everywhere. Awesome. Well, Danielle, I think we can advance the slide. So we've got another poll for the audience. How frequently do you review job cost data during a project? It's got that project closeout monthly, weekly, daily. We don't regularly use job cost data. While we're getting the vets. This is always an interesting one for me in a setting, coming from multiple size contractors and a few over the years because I have been in the companies that go, wait, job costs, what? We don't look at that. And then I've been at the one where I started where, man, he drilled it into me, know, kind of like a second breath, you know, it was just so natural. So these are always interesting to get the results of a pulse like this. Yep, and great responses here. It looks like weekly leading the way with monthly coming in, as the second option. I'd like you all to use those that chat if you could. On the monthly side, are we using accounting systems? Or Melissa, what do you think? Is that if they're using a monthly option, is that typically coming in from an ERP or something else? Typically, most monthlies are an ERP. I know that's how we do it on our end. We utilize, you know, what's coming in on from heavy bid, but I mean not heavy bid, heavy job, but our ERP is where we gather and that's where your source of truth is for your data because things like accounting invoices or labor dollars. Our setup takes our bid rates and uses them as our hourly rates. Well, that's not accurate per penny on that labor dollar. Our monthly are where we really kind of get the meat and potatoes from the ERP of saying, Hey, where are we? Where are we running? What do we need to adjust? What do we fix? We also do weekly or try to encourage weekly within our organization. And that is where the heavy job information comes in vital because it's enough, you know, it's not meant to be the ERP, but it's enough data, it's enough cost, it's enough to say, hey, how do we look right now to make an instant change? Because if you're a month down the road and there is a problem, you're too far gone to fix it. But if I'm catching it just your Wednesday of the following week, I bet I'm only a couple days past to go, hey, woah, let's down, hit the brakes and figure out how we how we change the rest of that operation. Yeah, absolutely. On the daily side, I'll see it implemented in a number of ways. It could still be back in that office, the project manager doing that review, or at times they put that into the hands of the foreman, with the tools on the time card itself, with the production quantities to look at it and say, how did I perform and how did I perform especially on the things that I can change? Right? So what are my labor hours and my equipment hours look like? Am I tracking against the budget that was set up, from HeavyBid from the original estimate? So those are things that we'll see on that daily basis, putting it more in the control of of the field, but still at times having that check, like you said, that audit, that compliance check make sure that those numbers are correct. Because without those being on point, the rest of the data is just junk in, junk out. That's how we say it. That's what we're pushing on our end is the daily view from what the foreman, goes back to that ownership. But also we are trying to push to our guys to looking at those hours. Equipment hours, labor hours. Equipment hours, labor hours. That is the most manageable thing that a foreman can adjust on any day. And if you're lending, you know, looking at those, if they are looking at those, then it's going to push up to the others in the departments, you know, within the managers and the construction managers and superintendents and, you know, forward from there. Yeah. So I've a follow-up question actually for Bill. Have you ever been in a situation where a job went so far sideways that you had to basically redo the forecast or the bid and say, Okay, we had originally projected X margin, and now we need to just call it what it is. The situation is different than what we thought. We need to see where we actually stand with this job and how did you handle that situation? Yeah, unfortunately, I have been in that situation, and I think anybody who is in that situation starts it with unfortunately. Yeah, I mean, at times it can be from multiple things. It can be from conditions change. It can be from a bad estimate to begin with. It can be from material pricing changes. A lot of times all of that stuff comes together for a perfect storm. And I've had to start over with a cost complete estimate per se. Right? And you pretty much just start over from the bottom using job cost estimating excuse me, not job cost estimate using job costing on where are we at today, how did we get here, and then moving forward on, you know, what are the plans for reconciliation and how do we move forward and trying to estimate that. At the end of the day, it's you you want to be as accurate as possible, but it's still an estimate. It's not an exactimate. It's an estimate. And you're liable to have those types of things that hit you. But it's not a it's not a fun process to have to go through that because, you know, you've got a bad job on your hands. But if you can get down to the costs and re estimate it and move up from the bottoms up per se, you can at least get yourself a handle on and start the process of correction. Well, I think this is another one of those topics where we can have some pride in construction and just look back and say, we've come a long way, because typically I think there's a stereotype that construction is a laggard as far as technology comes. And the poll that we've got eleven percent of companies that responded that said that they do job tracking daily, would have been unheard of ten years ago, you know. So I think that there's been a lot of progress, and then the weekly, that's fantastic. You know, I hear a lot of people using some kind of digital solution now. And even five years ago, if we think about like a pre COVID world, people were still doing things on paper. And I don't really hear that that much anymore. Yeah. John, if I could add to that real quick, when you're talking about the estimating side and having the right tools and the right technology, when it does come down to having to do some, I guess you'd call it, investigative estimating, trying to figure out what happened, what went wrong, and trying to rebuild something, having the right technology that can get you down to the details. I mean, I've used heavy bid, HSS heavy bid since it was on DOS way back in nineteen ninety seven. But it has the ability to and many other estimating programs do as well. But it has the ability to get all the way down to the activity level, the resource level, tracking level so you can find that. And that's very important when it comes to investigative estimating, I guess what you could call Yeah, absolutely. Melissa, you mentioned this earlier, but that, that idea of the, foreman in the field just really embracing that technology. I think what I found is working with the foreman, there's this perception that still lingers, and sometimes it's true, that they're not technologically savvy. What I found is that some of those guys can move through the iPad faster than I can as they switch between different applications to get their job done for for going into teams, for going into Excel, for going into a heavy job. The the movements that they have and the control that they have over that is actually insane, to see in real life. So, I I think that we are seeing that perception of old dog can't learn new tricks. That's just not true anymore and that people are really embracing technology now. Yeah, absolutely. I have a group of they call themselves, we're the old guys, you know, and they laugh because, you know, they're literally those fellows were still doing paper time sheets up to three months ago, you know, they were right there, their paper time. And even those guys, they'll call me, Miss Melissa, I know called you yesterday, you know, and I just walk them through and I'm like, you call me as you need me. And even those guys, like they said, they call themselves the old dudes still, you know, they're embracing it and they're doing it. And because of the way their job is set up, they're not, they're just doing it because they have to track their time. But I feel like if they're ever at a point on a job that they do have that ownership, I could get them on board. It wouldn't take much because they already are willing to learn that technology. Sometimes I laugh and I'm like, it's like teaching my eighty four year old dad how to use his iPhone. But they, hey, they jump on board. And what's, I will say, helping in the construction industry, you know, technology is everywhere these days. My kids barely use pen and paper at school. I don't know that I ever see a pencil in my son's hand, you know, in junior high, because everything's on a computer. So at that laborer level these days, those guys are so used to technology that seeing technology and construction isn't a problem. Know, do utilize some ice fields for clocking in and out and we give them instructions, but ninety percent of them don't need them. They just realize, oh, it's an app. They download it, look at it, figure it out and go on. That also does, that's a great tool to give ownership for those hours and to say, hey, you know, my supervisor didn't do this quite right or something like that. Because it happens. But yeah, construction has come a long way. Like, I've been in it a long time. I utilized HeavyJob twenty something years ago and it's awesome to see and it has helped. That eleven percent is a huge number from what I, we did it weekly when I started at construction but it was weekly, you know, pen and paper. We print those reports out of the system, out of the ERP and we would go through and calculate and check records and look at materials. But again, that owner pushed cost and, you know, of course, he's very successful in the state of Louisiana because he's done that. Yeah. On a side note, my dad just transitioned from Android to iOS. So, Melissa, if you have any advice for me, can get with me offline. We'll figure that one out. Yeah. Let's jump into, the next topic here, setting up for accurate data. We, we discussed a little bit about the junk data leading to bad decisions and what we can do around, auditing and those that compliance checks to make sure that that important data, is not junk data. I I wanna talk a little bit about the clean data and what it means really for fewer cost codes and how to implement a system such as Heavy Job. So Melissa, if you want to maybe pick out some of that middle topics and go through some of your experiences, I think that'd be good. Yeah. So the majority of my career was spent doing Louisiana DOT work. And if you know anything about Louisiana DOT, they tell you what your codes are going to be. They tell you what those cost codes are because they match their pay items and you don't really have to go into more detail unless you're just crazy and think that, you know, one concrete item needs ten cost codes. I've seen it done. But being at rigid with where we have a Marine side and an industrial, and then you have the heavy civil and this one has a bridge on it, but this one is just a bunch of dirt. Getting those cause codes isolated and to a standard has been a little trickier. What they did prior to my arrival was they set them up to DOT codes and my boss and I are kind of looking going, why are we set to DOT codes when that's not what we use? So we're actually looking at, do we want to alter? Do we want to create something that is more universal across all of our different departments? But we do, even though they're odd DOT codes for all the different departments, we do use a standard. Most of our jobs are set up. If you look for, you know, seventy two thousand seven hundred and one, it's going to be mobilization, demobilization across from a Marine to an industrial, it doesn't matter. That's going to be its code. You know, our safety, our mechanics, our, you know, anything like that. So, we did have done that to just kind of clean that up. So, no matter where you go, that's what you get. Yeah, perfect. And I think whenever we look at that implementation, we've seen it go from this excitement of I can only track three things right now on pen and paper to I can now track everything. Let's go ahead and put thirteen, twenty cost codes in there. It's like, woah, hold on. Our field can't do that. Let's dial it back into a reasonable number. It's a it's a back and forth to get that figured out. There's always this ongoing debate. When I talk to estimators and I talk to project managers alike, sometimes they like the control of the self perform. And there's always a fear about bringing in a subcontractor, especially a subcontractor that it's a specialized sub or something like that, and you don't know what their work is going to be like. So I wanted to get some input from the professionals here, both from the bid side and from the project management side. So obviously there's a cost to subcontractors, but if that cost for a subcontractor allows you to take your self performing crews and allocate them to another project, so that you don't have, you know, fifteen percent of your labor budget going to overtime, How does all of that play together, Bill, when you are thinking about do we self perform or do we subcontract out specific pieces of the bid or we just decide we are going to run the bid or we are going to run the project but we are going to manage subs? That's a great question. For us, labor ability is availability is right at the top. In fact, I misspoke, but labor ability is also at top, whether we can produce a quality product as well as a subcontractor. A lot of times, you know, the subcontractors that we look at, we look for ones that we have strong established relationships with that we know the quality is going to be high. They do this day in and day out. That's their expertise. And in our crews, at times, you know, we're we're a bit more general. We will do, ash movement or we'll do, treated materials, but then we might also do some pipe work. But we don't do that day in and day out. So we need to look at not only labor availability, labor ability. You mentioned here overtime trends and core competencies touched on that. But a real important one also is number four on your bullet is compliance and risk. When you're taking a look at the risk of the project and the risk of the scope that you want to subcontract out, again, it goes back to a company that does it well, does it every day. You've got a great relationship with and you know will have a great product. Whether you can perform that at that same level or not, you when you pay a little bit extra for a subcontractor, of the time, most of the time, almost all of the time, it's well worth it because you're you're alleviating the risk on your own company, but you're also alleviating the risk on the contractor, excuse me, on the owner because you're hiring that expert to do it. Yeah. Well, and Melissa, from the project management side, I've heard some PMs say, Well, I would just rather do it myself, the proverbial, If you want it done right, you do it yourself, versus having to go and clean up after a sub or whatever. What's been your experience there? Yes, I have heard that time and time again. Honestly, us, or in my experience, it's always been a matter of a lot of what Bill said, but also who the subcontractor is or what are we performing. It doesn't always come, you know, in my line of what job costing, I want to say, what's going to be the cheapest? That's my go to, what's going to be the cheapest? But those, and that's what we kind of have to remind those PMs on that case. Okay, so yeah, you possibly could, but can you? Because a lot of times there are other people in the company that know the strengths and weaknesses better than a PM. So we look at similar things, know, is that a subcontractor experience? At one of the companies I was at, there was just a standard. If you were doing this item to this item, you're subbing it out one hundred percent of the time. You know, if you're doing this particular item, then let's talk. Let's talk about it. Let's see, you know, are we doing, you know, a mile of this or are we doing five miles of it? If we're doing five miles, it won't cost us, it'll cost us as much as if we're doing a mile, it'll cost us more. But that sub is set up for the smaller operation. So let's go that way. So scope of work and size, you know, quantity of work has been something that I've seen analyzed a lot as well, just in my history. Because like I said, you know, cost is unit cost, but you know, if you're doing a mile versus five miles, that mobilization is the same for those same miles. So I've seen general contractors hire, you know, a sub because they're set up more for that smaller scope than the bigger. So using estimates to guide sub versus self perform decisions, we touched on it, we talked about it, but are there any final thoughts with regard to the estimates provided, the cost comparison baseline for deciding what to self perform, the risk mitigation aspect of it, alternate bid scenarios, and then empowering the PMs to make informed decisions. So do any of you want to provide some final thoughts around that before we take some questions from the audience? I can speak to estimate side on the cost comparison. If you if you've got the right tools and you've got the right estimating software, I know Microsoft Excel, it's very difficult to do comparison tools, but other software programs allow that. And so what we do when we're looking at subcontractor scope that we can do and we can do it well within our staff is we'll run a parallel estimate. We'll run a self perform cost, and we'll also collect subcontractor quotes from trusted and vetted subcontractors. And not only do we look at the cost, which it always comes down to cost, but we look at best value as well. Right? So there are times where we may be cheaper in the estimate. Then you have to take into account, we mentioned risk, we mentioned availability, we mentioned the best benefit for the project. And there are times where we choose a subcontractor that isn't as cheap as our self performed, but we find that the combination of everything together is the best value for the project. But the beauty of having the proper software is that you can build those parallel estimates and then you can switch them on and off. Right? You could say, okay, this affects this over here. If I do the work, then I have to mobilize X, Y, and Z more pieces of equipment that I may not have before. There's so many other things than just the direct work you have to think as a whole. And when you can build those parallel estimates, I wouldn't necessarily call them estimates, but the parallel activities or parallel bid items, you can really see that comparison well on the estimating side. Melissa, before we open it up to the questions, did you have any final thoughts on any of these items? Just looking at the last one about empowering those PMs, I think that definitely happens from time to time in our company where they say, Okay, well, we've picked out XYZ for these reasons, but these are the reasons we haven't decided on sub or self perform for this item. And it's at that point that the PMs can really dig into that labor availability. They can dig into what other jobs crews needed at the time versus are their crews this or, you know, like we do have a Marine and a Civil Division. So when the Civil needs Marine work, you know, obviously we want our guys to do it. But what's that availability there? Are we going to make sure we've got something available? So we, you know, empowering those guys is still, I think, very vital part of using those, you know, get let's let me get the the detailed evaluation from Bill that tells me dollar for dollar what's going on and then let that PM and his team make that decision. It definitely works well, know, on the right bid item. Again, goes back to scope of work and all of that at the end of the day. Excellent. Well, so I'm going to start reading off some of these questions. There's no particular order to it, I'm just going to hit on as many as we can before time's up. But I had a question come in, this one's interesting. So Brad Keeley, do you do anything special to recruit your workforce now with the status of the workforce today? I can't really speak to Go ahead. Ahead, No, it's hard for me to speak to that where I'm at because we do have a great HR department. We have a full hiring group. You know, they've utilized LinkedIn a lot for that. And I know at our old company, it was a smaller, you know, I say mom and pop because, you know, I think they owned the town basically we lived in. There was a lot of word-of-mouth that really had to happen. It was just, hey, do you know someone? And we really had to utilize that. Wish someone had the golden ticket to how that works for finding those right people. Well, and what I'm gonna do, I'm gonna actually transition this back to Adam so that he can go through the queue. Absolutely, and this has been a great presentation. So, of course, any questions, keep them coming. So we'll just, jump right into the additional questions we have here. One that was specific to the DIT cost coding comment. If you are using general DOT codes for your work, how are you using that data to see friends from job to job? How do you analyze it to create historical data and trends? Because we're using the same code for the same style of work. If it's dirt work, you know, there's this list of codes. If it's pipe work, there's this list of codes. If it's marine work, there's this list of codes for the marine work. So even though we don't do DOT work, that's just what they used as a guide, but the guide is across the board, across all of the divisions. So you can still, all that historical data, if you run, it's going to be pretty much the same codes for that. Excellent, excellent. Then we're getting our participation webinar feedback survey up. So while people are filling that out, we'll go to another question. How do you balance the amount of cost codes on a project in terms of trying to gather historical data versus overwhelming the field managers? Yeah. I think we touched some on that. Right? It's It's a balance of what can actually be tracked. And I think going through those loops that Melissa talked about with auditing. Melissa, you want jump a little more on that? Yeah. From a project control standpoint, we always want to say pay. If it has a pay item, it needs a Costco. Because from a cash management standpoint, you know, and throwing accounting knowledge, because that's where my brain sticks, is I want to pay out on what I'm getting paid for. I don't necessarily want to pay out if I haven't gotten paid. So we're a code to code and I tell my guys that I can add multiple pay items to cost codes, I can't add, no, I'm sorry I said that backwards. I can add multiple cost codes to a pay item, but I cannot add multiple pay items to a cost code. So make sure that you're not going much bigger than what you're getting paid for, but also cram it down. Don't you know say oh well I have this pay item but it you know five pay items with no cost items. You know where does that come from? So I think a general rule is easy pay item to cost basic start and then expand as needed. Excellent. So I was waiting on the AI questions. How are you utilizing AI ChatGPT to reduce workload when developing and reviewing cost estimates or takeoffs? That's a really good question. AI ChatGPT, that's all real recent technology. It's just starting to come out. I believe there's some good quantity takeoff AI out there. Personally, myself, I don't like to use AI for quantity takeoffs because we look at things in multiple facets and multiple ways. But how I how I have to get started using AI is for research specifications review. When you have to go through a two thousand page document and you're searching for things, you know, you may use Adobe or Bluebeam to do a quick search, but you can literally have a conversation with AI on what is the testing requirements for asphalt, for example, or for fly ash compaction. That's all you have to type. And for the most part, it will search that two thousand page document in about thirty seconds and give you those testing results. Now, I've learned this the hard way. Always double check it because it doesn't necessarily fully understand what you're saying. But that's where I've really found a real benefit to the AI ChatGPT just being one avenue of that. I mean, you can use all kinds of Microsoft Copilot three sixty, whatever it may be. But is is the research time savings when you are really trying to figure out what is the specification? What is the documents I have to go through? The types of projects that I bid personally will get a document package that is, I don't know, it can be in the range of ten thousand pages with all the different document spreads that we have to go through. It's been a huge help for that. Huge time savings. Excellent. Excellent. All right. Another good one. With new tools like Bulk Exchange integrating with HCSS to directly solicit RFPs from material suppliers such as asphalt, aggregate, cement, concrete, What HCSS partner tools are bringing added value such as bulk exchanges integration with HCSS to get quotes and accurate market resource pricing? Yeah. An excellent question there. We have a pretty good partner portal, that we've looked across really the the whole, sphere of construction technology, and we really selected partners that added in more value that we weren't currently adding in, to that space. So you look at Bulk Exchange as a great example of that. We have quite a few on the the equipment side. We have quite a few on, the estimating side as well, really just looking for those integrations that make sense and really sourcing it from tools that our customers are already using. So we do have a full partner portal if you're interested in checking that out, see who all we integrate with. But really across the spectrum from estimating to operations to fleet management, we have different integrations that can really piece together a perfect solution for you all. That's excellent. Excellent. Another one, can you walk us through a real world example of how data helped you make a tough subcontract versus self perform decision? Yeah, I can. So one of the tough decisions, again, as we talk about whether you can do it cheaper or whether a subcontractor can do it cheaper. And a lot of times when we take a look at our our costing just just because of maybe we have some unique ways to approach things, our cost is less. But then we go back and we look at the data and at the other end of the spectrum on the whole product as a whole. Were we able to do other areas of the work cheaper? Were we able to do other areas of the work faster? We can see that in the data at the end of the job or during the job as that subcontractor scope is moving forward. And we've made some tough decisions to give up work to a subcontractor because based upon the data, it would be more beneficial for the project. Excellent. Excellent. How do you balance the need for detailed cost tracking while not overwhelming your field crews? I think we've kind of touched on that and basically just, you know, make sure, your pay item, you got a code for a pay item and then don't go too much in detail past that unless it's something maybe by area or by phase or something like that. If you keep as much to pay item versus cost code as possible, then it really makes for easier cost tracking so those field managers know, well, I'm, you know, working on this pay item. So. Excellent, excellent. Here's a very topical one. Do you do anything special to recruit your workforce now with the status of the workforce today? One thing that one thing that we do here at NorthStar, since we do work nationally and we work in different areas all the time, is even as early as at the time that we're beginning to bid the project, we reach out to the local labor force offices. We reach out to other subcontractors in the area that have done work that we have good relationships with. And we try to get those feelers out already to see what the workforce is going to be like. And not only that, but, you know, we we let local folks know that that we're bidding. We want to bring in as many local subcontractors, suppliers, vendors and local labor force as much as possible. And we start that process all the way as early as as the estimate. So by the time that, you know, if we're lucky enough to win the project and we're now recruiting, they know who we are. They know what we're about. They know that we're looking for them. And that's that's actually been really helpful to us. In addition to all of the normal stuff, you know, the LinkedIn, the job boards, those types of things. But also just trying to get our name out there and understanding what type of contractor we are and we're looking for good folks. And I would say your AGC chapter could be another great resource to utilize as well. AGC is heavily invested in workforce development, and we've seen some good things come out of there, both for the larger contractors that have the ability to, say, create a whole training environment in a training center, and those smaller contractors to to get involved and like you said, get your name out there. Yeah. I I heard a creative company, had a second chance ministry organization partner with them. And so they were able to have a nice little bench of folks that they could interview and train. So there's a lot of creative things going on right now. Wonderful. Wonderful. Well, unfortunately, that's all the time we have for questions today. Please join me once again thanking John Capello, Andrew Fowler, Bill Overlander, and Melissa Mott as well as today's sponsor, HCSS. Now if you have any additional questions or comments, please do not hesitate to click the email us button on your console, and we will share them with the presenters so they can respond to you directly. If you did not have a chance to fill it out earlier, you will be redirected shortly to the post event survey. We look forward to hearing how to make our programs work better for you. Please visit ENR dot com backslash webinars for the archive of this presentation to share with your colleagues as well as information about our upcoming events. Thanks again for trusting us with your time. Have a great day.